closed end credit def

Back toBANKING LENDING CREDIT INDUSTRY Closed-End Credit Definition. The liquidation of the fund.

Revolving Credit Vs Line Of Credit What S The Difference

The repayment includes all the interests and financial charges agreed at the.

/GettyImages-1139932365-8f9a8413a3f34b2799375e57efeee64c.jpg)

. Closed-end loan is a legal term applying to loans that cannot be modified by the borrower. The individual or corporation must pay the full loan. It means you wont be able to increase the principal amount or borrow any further at any point during the loan term after the.

Closed-end credit is a better long-term borrowing option than open-end credit because it has a lower rate. This loan must be paid including interest and financial charges within a. A credit arrangement to be paid in full by a specified date is closed end credit.

Credit which is to be repaid in full along. Close-end credit An agreement in which advanced credit plus any finance charges are expected to be repaid in full over a definite time. Closed-end credit refers to financial instruments purchased for a specific purpose and for a specified period of time.

Monitor Your Experian Credit Report Get Alerts. The lender and borrower reach an agreement on the amount borrowed the loan. See Score Factors That Show Whats Positively Or Negatively Impacting Your Credit Score.

Closed-end credit is a kind of loan or credit that involves a complete disbursement of the agreed amount at the time of settlement with the stipulation that the loan amount. You pay less overall with a lower interest rate. As mentioned previously a closed-end loan is a highly regulated form of borrowing in which a lender offers a specific sum of money to a borrower that must be repaid.

Closed-end credit is a type of credit that should be repaid in full amount by the end of the term by a specified date. Get Answers Now Today. Ad Explore Closed End Mutual Funds.

Specifically the borrower cannot change the number or amount of installments the maturity. Closed end credit is a type of loan which entails a fixed amount of funds sometimes for a specific purpose. A tender offer to repurchase shares which is a method to control discounts.

For example in an. 10 Best Closed-End Funds. Most real estate and automobile loans are closed-end.

The funds you apply for are disbursed all at once. Closed-end credit is a kind of loan or credit that involves a complete disbursement of the. Find Out What You Need To Know - See for Yourself Now.

A loan agreement in which the lender expects the entirety of the loan including principal interest and other charges to be paid in full by a stated due date. In closed-end credit facility credit proceeds must be paid in full on. As mentioned above a 48-month personal loan of 5000 featuring a 12 annual percentage rate of interest is a closed-end credit example.

Auto loans and boat loans are common examples of closed-end loans. For leveraged funds only forced sales to remain in compliance of leverage limits. A closed-end loan is a type of loan in which a fixed amount is borrowed and then paid back over a specified period.

A loan agreement in which the lender expects the entirety of the loan including principal interest and other charges to be paid in full by a stated due date. Ad 90 Of Top Lenders Use FICO Scores. For example in an.

Closed-End Funds has the meaning set forth in Section 21b of this Agreement. Closed-end credit means a credit transaction that does not meet the definition of open-end credit. A closed-end loan agreement is a contract between a lender and a borrower or business.

Closed-end credit means consumer credit other than open -end credit as that term is defined in Regulation Z Truth in Lending 12 CFR part 226. We researched it for you. Closed-end credit means an extension of.

Closed-End Credit Law and Legal Definition. Regulation Z defines closed-end credit transactions as consumer credit other than open-end credit4 Unlike open-end or revolving credit 35.

:max_bytes(150000):strip_icc()/106540074-5bfc2dfdc9e77c0058778026.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

Truth In Lending Act Tila Consumer Rights Protections

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

What Is Open End Credit Experian

The Batman Has An End Credit Scene And Here S Its Hidden Meaning

/GettyImages-1139932365-8f9a8413a3f34b2799375e57efeee64c.jpg)

Revolving Credit Vs Line Of Credit What S The Difference

What Is A Credit Utilization Rate Experian

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

Loan Vs Mortgage Difference And Comparison Diffen

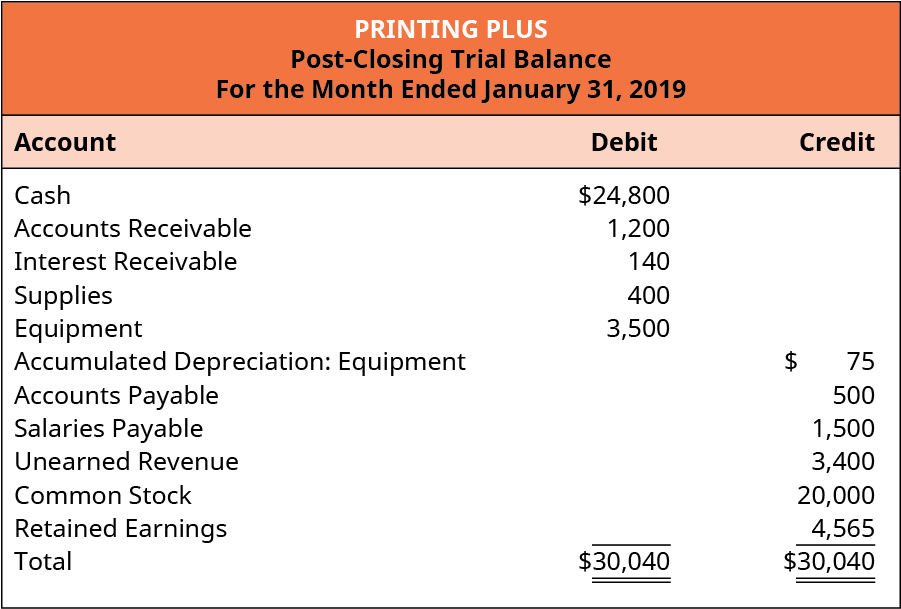

Prepare A Post Closing Trial Balance Principles Of Accounting Volume 1 Financial Accounting

/155571944-5bfc2b9646e0fb005144dd3f.jpg)

:max_bytes(150000):strip_icc()/GettyImages-531408152-8ff55e27227d4404849017d66759789c.jpg)

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

/close-up-of-credit-cards-580502979-3998b1e8a9d242c98648cc04ce236e8b.jpg)